In the fast-paced world of cryptocurrency trading, having a solid grasp of technical analysis can be the difference between success and failure. While fundamental analysis focuses on the intrinsic value and real-world applications of cryptocurrencies, technical analysis provides traders with tools to interpret market data, identify trends, and make informed trading decisions. This comprehensive guide will delve into the world of technical analysis, exploring key indicators that every crypto trader should understand and utilize.

Table of Contents

- Introduction to Technical Analysis

- The Importance of Charts in Crypto Trading

- Moving Averages

- Relative Strength Index (RSI)

- Moving Average Convergence Divergence (MACD)

- Bollinger Bands

- Fibonacci Retracement

- Stochastic Oscillator

- On-Balance Volume (OBV)

- Ichimoku Cloud

- Combining Multiple Indicators

- Common Pitfalls in Technical Analysis

- Advanced Techniques and Tools

- Conclusion

Introduction to Technical Analysis

Technical analysis is a trading discipline employed to evaluate investments and identify trading opportunities by analyzing statistical trends gathered from trading activity, such as price movement and volume. This method operates on the assumption that historical trading activity and price changes of a security can be valuable indicators of the asset’s future price movements when combined with appropriate investing or trading rules.

Key principles of technical analysis include:

- Market action discounts everything: All relevant information is already reflected in the price.

- Prices move in trends: Once a trend is established, future price movement is more likely to be in the same direction as the trend than to be against it.

- History tends to repeat itself: Market participants tend to provide consistent reactions to similar market stimuli over time.

While these principles were developed for traditional financial markets, they have proven to be equally applicable to the cryptocurrency markets, which often exhibit strong technical patterns due to their speculative nature and high volatility.

The Importance of Charts in Crypto Trading

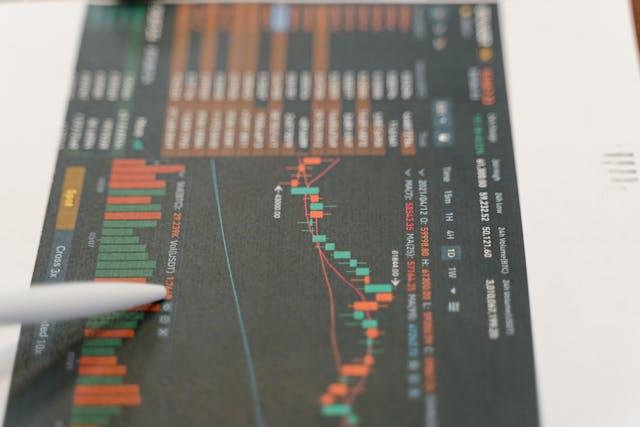

Charts are the foundation of technical analysis. They provide a visual representation of an asset’s price movement over time, allowing traders to identify patterns and trends. The most common types of charts used in crypto trading are:

- Line Charts: Simple and easy to read, showing the closing prices over time.

- Candlestick Charts: Provide more information, showing opening, closing, high, and low prices for each time period.

- Bar Charts: Similar to candlestick charts but with a different visual representation.

Candlestick charts are particularly popular among crypto traders due to their ability to convey a lot of information at a glance. Each candlestick represents a specific time period (e.g., 1 hour, 4 hours, 1 day) and shows:

- The opening price

- The closing price

- The highest price reached during the period

- The lowest price reached during the period

Understanding how to read these charts is crucial before diving into more complex technical indicators.

Moving Averages

Moving averages are among the most widely used technical indicators in crypto trading. They smooth out price data to create a single flowing line, making it easier to identify the overall trend.

Types of Moving Averages

- Simple Moving Average (SMA): Calculated by adding up the closing prices for a specific number of periods and dividing by that number.

- Exponential Moving Average (EMA): Gives more weight to recent prices, making it more responsive to new information.

How to Use Moving Averages

- Trend Identification: When the price is above the moving average, it’s generally considered an uptrend. When it’s below, it’s considered a downtrend.

- Support and Resistance: Moving averages often act as support (in uptrends) or resistance (in downtrends).

- Crossovers: When a shorter-term moving average crosses above a longer-term moving average, it’s often seen as a bullish signal, and vice versa.

Popular moving average periods include the 50-day and 200-day SMAs for longer-term analysis, and 10-day and 20-day EMAs for shorter-term trading.

Relative Strength Index (RSI)

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements. It oscillates between 0 and 100 and is typically used to identify overbought or oversold conditions in a traded asset.

How to Interpret RSI

- Overbought Conditions: Traditionally, an RSI reading of 70 or above is considered overbought.

- Oversold Conditions: An RSI reading of 30 or below is considered oversold.

- Divergences: When the RSI diverges from the price action, it can signal a potential reversal.

RSI in Crypto Trading

Crypto markets are known for their volatility, so some traders adjust the traditional overbought/oversold levels. For instance, using 80 as overbought and 20 as oversold to account for the stronger trends often seen in crypto markets.

Moving Average Convergence Divergence (MACD)

The Moving Average Convergence Divergence (MACD) is a trend-following momentum indicator that shows the relationship between two moving averages of an asset’s price.

Components of MACD

- MACD Line: The difference between a 12-period EMA and a 26-period EMA.

- Signal Line: A 9-period EMA of the MACD Line.

- MACD Histogram: The difference between the MACD Line and the Signal Line.

How to Use MACD

- Crossovers: When the MACD Line crosses above the Signal Line, it’s considered a bullish signal. When it crosses below, it’s bearish.

- Divergences: When the MACD diverges from the price action, it can signal a potential reversal.

- Centerline Crossovers: When the MACD Line crosses above the centerline (0), it indicates a bullish trend. Crossing below indicates a bearish trend.

MACD is particularly useful in crypto trading for identifying potential entry and exit points, especially in trending markets.

Bollinger Bands

Bollinger Bands are a volatility indicator that consists of three lines:

- A simple moving average (typically 20-day) in the middle

- An upper band (20-day SMA plus two standard deviations)

- A lower band (20-day SMA minus two standard deviations)

How to Use Bollinger Bands

- Volatility Measurement: The wider the bands, the more volatile the market.

- Overbought/Oversold Conditions: Prices touching the upper band might indicate overbought conditions, while touching the lower band might suggest oversold conditions.

- Breakouts: When the price moves outside the bands, it often signals a continuation of the trend.

Bollinger Bands are particularly useful in crypto markets due to their ability to adapt to volatility, which is a defining characteristic of cryptocurrency trading.

Fibonacci Retracement

Fibonacci retracement is a method of technical analysis for determining support and resistance levels. It is based on the idea that markets will retrace a predictable portion of a move, after which they will continue to move in the original direction.

Key Fibonacci Levels

The most commonly used Fibonacci retracement levels are 23.6%, 38.2%, 50%, 61.8%, and 78.6%.

How to Use Fibonacci Retracement

- Identifying Potential Reversal Levels: These levels often act as support or resistance.

- Setting Price Targets: Traders might aim to take profits at Fibonacci levels.

- Determining Entry Points: Some traders use Fibonacci levels to enter trades in the direction of the overall trend.

Fibonacci retracement is popular among crypto traders for its ability to identify potential turning points in the market, especially after significant price moves.

Stochastic Oscillator

The Stochastic Oscillator is a momentum indicator that compares a particular closing price of an asset to a range of its prices over a certain period of time. It consists of two lines: the %K line and the %D line.

How to Interpret the Stochastic Oscillator

- Overbought/Oversold Conditions: Readings above 80 are considered overbought, while readings below 20 are considered oversold.

- Crossovers: When the %K line crosses above the %D line, it’s considered a bullish signal, and vice versa.

- Divergences: When the oscillator diverges from the price action, it can signal a potential reversal.

The Stochastic Oscillator can be particularly useful in ranging crypto markets for identifying potential reversals.

On-Balance Volume (OBV)

On-Balance Volume (OBV) is a technical indicator that uses volume flow to predict changes in stock price. The theory behind OBV is that volume precedes price movement.

How to Use OBV

- Confirming Trends: If OBV is moving in the same direction as the price, it confirms the trend.

- Predicting Reversals: If OBV moves contrary to the price trend, it might signal a potential reversal.

- Breakouts: A rising OBV while price consolidates might foreshadow an upward breakout, and vice versa.

OBV can be especially useful in crypto markets, where large volume movements often precede significant price changes.

Ichimoku Cloud

The Ichimoku Cloud, also known as Ichimoku Kinko Hyo, is a comprehensive indicator that defines support and resistance, identifies trend direction, gauges momentum, and provides trading signals.

Components of the Ichimoku Cloud

- Tenkan-sen (Conversion Line): (9-period high + 9-period low)/2

- Kijun-sen (Base Line): (26-period high + 26-period low)/2

- Senkou Span A (Leading Span A): (Tenkan-sen + Kijun-sen)/2

- Senkou Span B (Leading Span B): (52-period high + 52-period low)/2

- Chikou Span (Lagging Span): Close plotted 26 periods in the past

How to Use the Ichimoku Cloud

- Trend Identification: When price is above the cloud, the trend is up. When it’s below, the trend is down.

- Support and Resistance: The cloud itself acts as support and resistance.

- Momentum: The relationship between the Tenkan-sen and Kijun-sen lines indicates momentum.

While complex, the Ichimoku Cloud can provide a wealth of information for crypto traders willing to learn its intricacies.

Combining Multiple Indicators

While each indicator can provide valuable insights on its own, combining multiple indicators often leads to more reliable trading signals. Here are some popular combinations:

- Moving Averages + RSI: Use moving averages to identify the trend, and RSI to gauge momentum and potential reversal points.

- MACD + Bollinger Bands: MACD for trend and momentum, Bollinger Bands for volatility and potential breakouts.

- Fibonacci Retracement + Stochastic Oscillator: Use Fibonacci to identify potential reversal levels, and Stochastic to confirm overbought/oversold conditions at these levels.

When combining indicators, it’s important to avoid redundancy. Choose indicators that provide different types of information to get a more comprehensive view of the market.

Common Pitfalls in Technical Analysis

While technical analysis can be a powerful tool, it’s important to be aware of its limitations and common pitfalls:

- Over-optimization: Fitting indicators too precisely to historical data can lead to poor future performance.

- Ignoring the Bigger Picture: Focusing too much on short-term charts and ignoring larger trends.

- Confirmation Bias: Looking only for indicators that confirm your pre-existing views.

- Neglecting Fundamental Factors: In crypto markets, news and fundamental developments can override technical factors.

- Over-reliance on a Single Indicator: No single indicator is perfect; using multiple indicators can provide a more balanced view.

Advanced Techniques and Tools

As you become more comfortable with basic technical analysis, you might want to explore more advanced techniques:

- Elliott Wave Theory: A method of technical analysis that looks for recurrent long-term price patterns related to persistent changes in investor sentiment and psychology.

- Harmonic Patterns: Price patterns that use Fibonacci numbers to predict reversals.

- Market Profile: A technique that organizes daily price and volume information into a simple graphic, allowing traders to see trading activity at different price levels.

- Machine Learning and AI: Some traders are now using machine learning algorithms to identify patterns and make predictions.

Remember, while these advanced techniques can be powerful, they also require significant study and practice to use effectively.

Conclusion

Technical analysis is a vital skill for any crypto trader, providing valuable insights into market trends, potential reversal points, and optimal entry and exit levels. The indicators and techniques discussed in this guide – from simple moving averages to complex systems like the Ichimoku Cloud – form the foundation of technical analysis in cryptocurrency markets.

However, it’s important to remember that no indicator or combination of indicators is infallible. The cryptocurrency market is known for its volatility and can be influenced by a wide range of factors, many of which are not reflected in price charts. Therefore, while technical analysis should be a key part of your trading strategy, it should not be the only factor in your decision-making process.

The most successful crypto traders often combine technical analysis with fundamental analysis, sentiment analysis, and a solid understanding of market dynamics. They also practice rigorous risk management, never risking more than they can afford to lose on any single trade.

As you continue your journey in crypto trading, remember that mastering technical analysis is an ongoing process. Markets evolve, and new tools and techniques are constantly being developed. Stay curious, keep learning, and always be prepared to adapt your strategies as market conditions change.

Whether you’re day trading, swing trading, or investing for the long term, a solid grounding in technical analysis can help you make more informed decisions and potentially improve your trading results. Use this guide as a starting point, practice with demo accounts before risking real money, and gradually develop your own unique approach to trading the exciting and dynamic world of cryptocurrencies.